Soaring drought and desertification leading to giddying drops in food production; roads filled with overturned cars after flooding; record-breaking storms causing power cuts, huge structural damage, transport paralysis, injury and death are just some of the recent weather events increasingly attributed to a failure to tackle climate change and cited as a foretaste of the chaos that will ensue without immediate and drastic steps to address it.

Banks taking inadequate climate change measures can also experience chaos and disruption as a result, as the likes of HSBC and Standard Chartered found at their AGMs this year, along with Barclays. The bank’s previous AGM had been dominated by criticism of its environmental policies and fossil fuel financing, professed concern from the board, a shareholder resolution that would require the bank to do better – opposed by the board, and ultimately unsuccessful – and a promise to produce improved targets and policies in time for a non-binding vote of approval this year. Those proved to be limited in ambition and scope, and to fall very short of the urgent exhortations from authorities such as the UN and IEA.

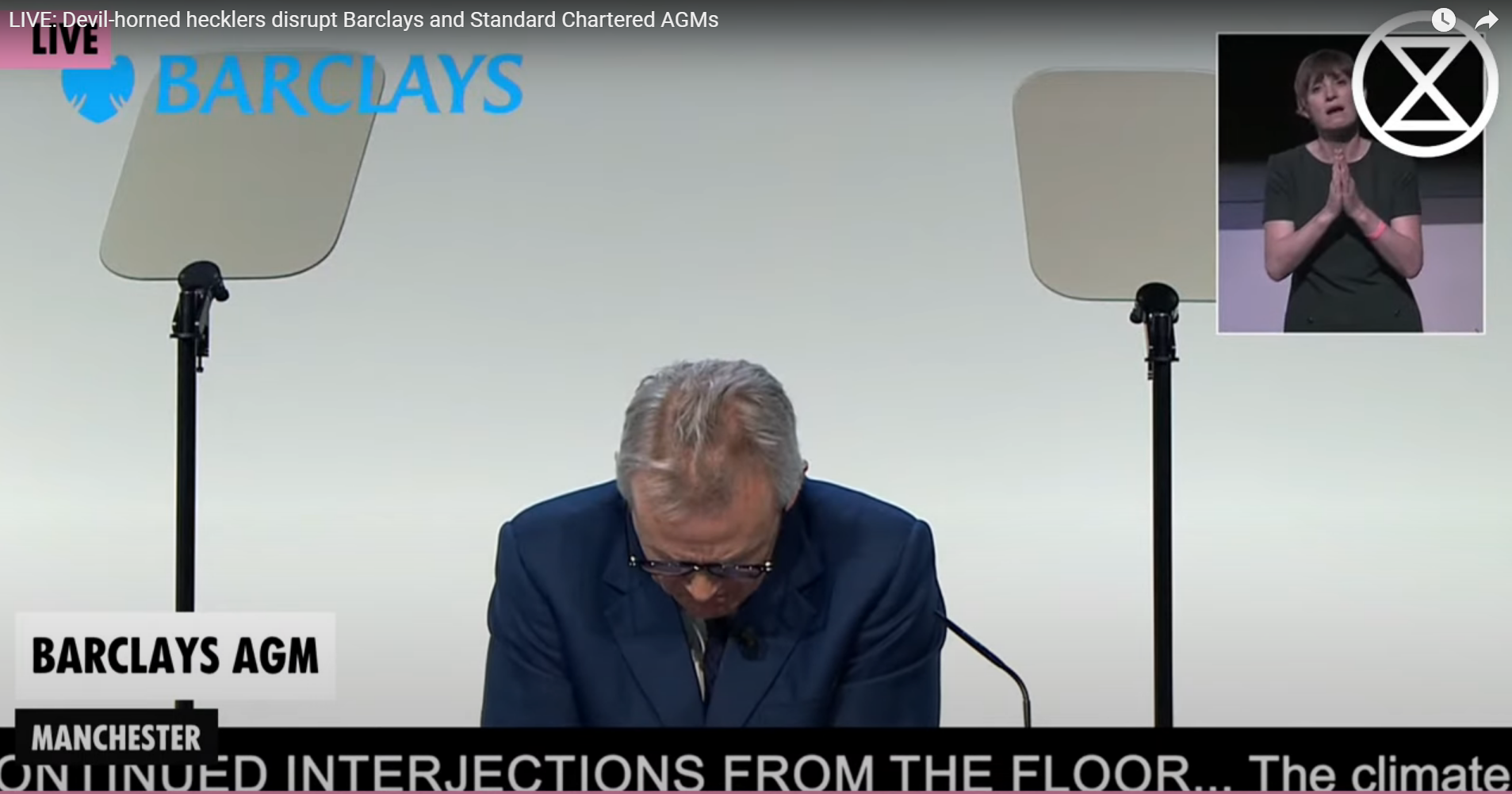

Following years of protests and attempts at engagement, frustrated protesters chose this year to force the issue at Barclays’ AGM. For an hour or more, the business of the meeting was delayed by condemnation from the floor of the bank’s support for fossil fuel expansionists, impassioned interventions on behalf of children set to inherit a devastated planet, declamations from some stood on chairs, with others glued to chairs to impede removal, metaphorical soundings of the climate alarm using personal alarms, peppered with apologies to shareholders for the disruptive but essential obstruction of AGM proceedings. When formal Q&A eventually began, censure of the bank continued. Chair Nigel Higgins – pictured above, and reportedly flustered by the challenges – noted Barclays’ new IEA NZE (1.5°C) alignment in its defence, glossing over the unambitious details. He was eventually pressed to agree to the board being briefed by former Chief Scientific Advisor Sir David King on the need for much more urgent climate action.

One in five shareholders voted against the management in the advisory ‘Say on Climate’ vote intended to approve Barclays’ new policies. Although a significant number to reject a management-backed resolution, the figure shows that too few institutional shareholders (with some notable exceptions) are using their voting power to push banks like Barclays to take real action such as phasing out funding to fossil fuel clients. Since the Barclays AGM, BlackRock – who abstained from voting on the shareholder-led resolution last year that would have committed the bank to just that kind of action, and who voted with the bank this year to approve its new climate policies – has explicitly stated its intention not to support shareholder resolutions that prescribe this kind of environmental action, since “we do not consider them to be consistent with our clients' long-term financial interests”.

In purely monetary terms, as the escalating climate crisis collapses economies and wipes out increasingly large amounts of shareholder value, that view may prove short-sighted. What is more telling, and likely to reinforce campaigners’ views that financial institutions can’t be trusted to act responsibly, is how it ignores the long-term or even short-terms interests of the planet and its inhabitants.