It all sounds truly heartfelt. "The extra detail and targets we are sharing today are another step towards achieving our net zero ambition," announces the letter from Barclays' Group Chairman, lauding the promised detail update on its widely-scorned professed green ambitions announced earlier in the year and claiming to focus on the transition to a low-carbon economy. "We believe our net zero ambition and Paris alignment commitment represent the best way for Barclays to help accelerate that transition", proclaims the fanfare. But the details, obfuscated with a Barclays-specific metric called BlueTrack, tell a different story.

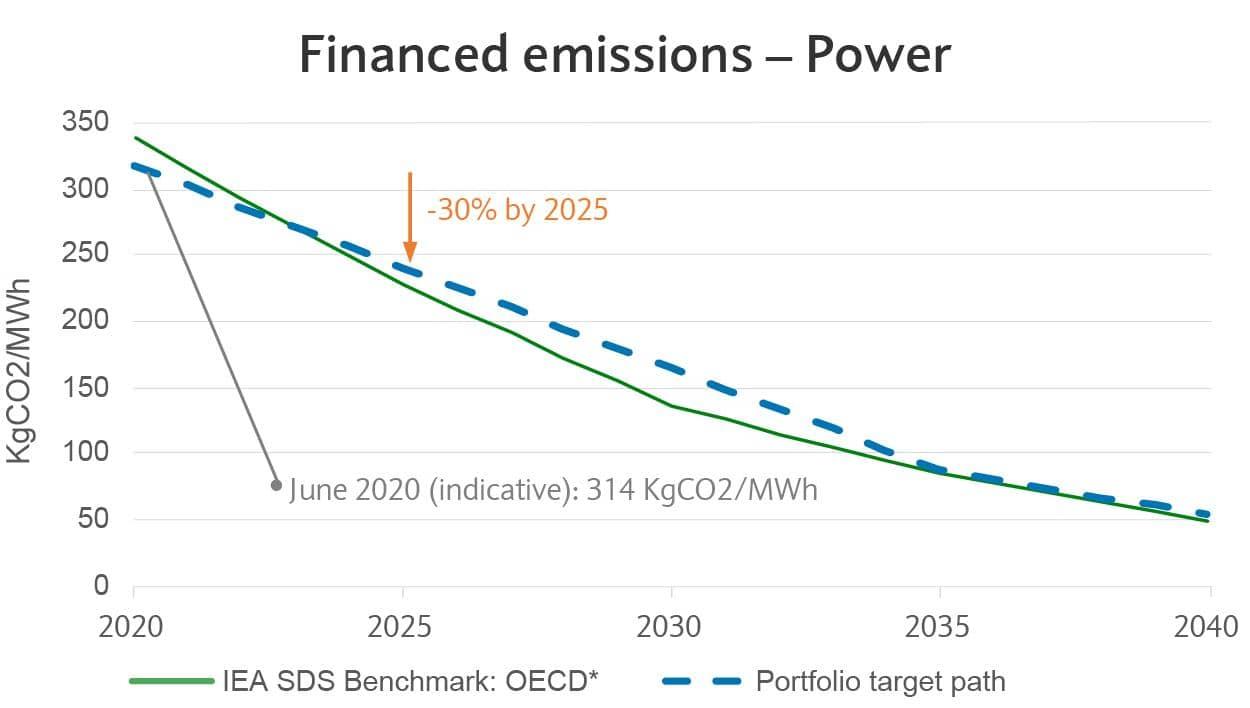

BlueTrack sets great store by reducing carbon 'intensity' - which has nothing to do with lowering total CO2 emissions, but just measures how much CO2 is emitted per unit of output. So when Barclays boasts that their power portfolio emissions intensity "will reduce 30% by 2025", this just means they'll switch some of their financing of the more CO2-intensive power generation (like coal) to the less CO2-intensive (like gas). There's no target for reducing total CO2 emissions in their power portfolio at all (and even the 'intensity' target is 5 years away). But perhaps that seems churlish. Isn't it better to switch to generating power from gas instead of coal? Apart from the obvious - if you're not reducing overall CO2 emissions, you're driving climate breakdown just as hard - the short answer is 'no'. For numerous reasons, gas "cannot form a bridge to a clean energy future", as recognized in the EU's sustainable finance drafting.

An approach that unambitious to decarbonisation needs considerable spin to look more impressive. That's just what the graph above on Barclays' climate dashboard is for - seemingly showing that Barclays' approach is more-or-less inline with the Sustainable Development Scenario (SDS) of the International Energy Agency (IEA). So surely that's ok? Alas, the SDS isn't quite as green as it sounds:

- it targets net-zero-by-2070, not the net-zero-by-2050 claimed by Barclays

- it only gives a 50% chance of keeping temperature increase under 1.5°C by 2100

- that relies on massive deployment of 'negative emissions technologies' that either do not exist or are extremely unlikely to be practical at the huge scale required

- it's the same scenario used by the fossil fuel industry - at conferences organised by Barclays, for instance - to make 'compliant' plans for the world to burn almost as much oil and gas in 2040 as it does today

As biased as the IEA is (more about that here) even it has acknowledged in its 2020 World Energy Outlook that "the possibility of a large level of net-negative emissions (i.e. net removal of CO2 from the atmosphere)" may need to be ruled out, and so has introduced a Net Zero Emissions 2050 case (NZE2050). The difference between it and the SDS is quite stark, as shown for example by this chart:

The NZE2050 case only provides a 50% chance of keeping global warming below 1.5°C. Barclays' 'target path' is taking us to a level of warming certainly above that - and warming of, say, 2°C is even more serious than 1.5°C. More importantly, the more warming occurs, the higher the chance of feedback loops rapidly amplifying that warming, leading to further ecosystem collapse and a largely-uninhabitable planet.

There's plenty more to disappoint in the update on Barclays' climate ambitions. However you look at it, the bank has a long way to go before being celebrated, rather than targetted, by environmental campaigners, and continues to merit censure from all sides.