A new survey of 2,000 Barclays and HSBC customers, carried out by ICM Unlimited, has revealed that while 80% were unaware their banks invested in fossil fuels, a significant number - 11% of the Barclays customers - would be 'very likely' to consider switching banks having been presented with the facts about them. Campaign group Market Forces, who commissioned the research, estimate this could mean around 3 million customers leaving those banks for more ethical alternatives. This reinforces the outcomes of recent polling by Deloitte of 1,250 customers of UK incumbent and challenger banks, which found that three-fifths would leave their bank if it were linked to social or environmental harm - even if it had the best offer.

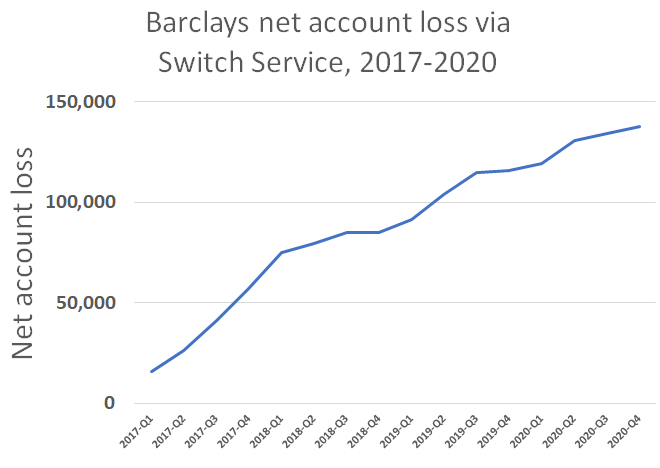

For a bank losing far more customers via current account switching than it gains, as shown in the graph above (source: CASS), these results should set alarm bells ringing. As we continue into 2021, with COP26 drawing nearer, and Brexit and the pandemic (all being well) fading into the past, UK headlines will increasingly feature environmental themes. Sitting in bottom place of the Good Shopping Guide's table of ethical banks, Barclays is unlikely to welcome the negative attention it will draw as the biggest funder of fossil fuels in Europe. Coupled with churn at the most senior levels, with increasing rumours of the departure (under something of a cloud) of CEO Jess Staley, and chairman Ian Cheshire quitting this year, the bank may have quite a difficult period ahead - and if the recent surveys are anything to go by, the line of net account losses will continue to climb.