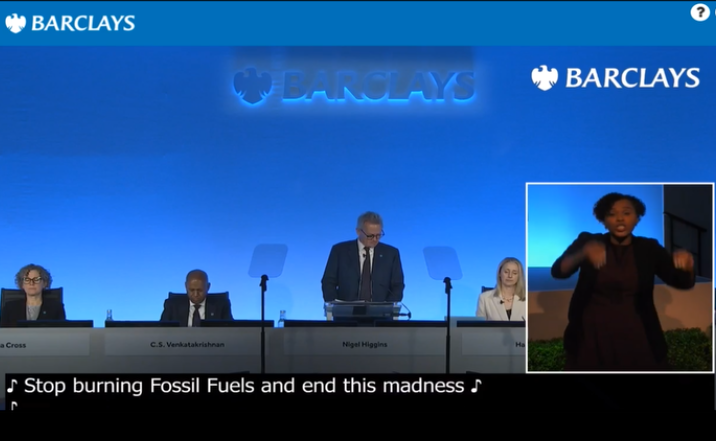

Following its deforestation shaming, inadequate fossil-fuel policy revisions, and censure in a high-profile open letter, Barclays’ 2023 AGM was unlikely to pass without protest. Even so, the bank’s board was taken aback by over seventy Climate Choir Movement singers’ united condemnation of how Barclays continues to finance environmentally-devastating business activities, adapting the Spice Girls’ hit, ‘Stop’. Lyrics such as, “Stop right now, no more oil and gas, stop burning fossil fuels and end this madness … hey you, burning up the Earth, gotta stop it now baby we have had enough” were transcribed on the meeting’s large projection screen and interpreted by the talented signer, both thoughtfully provided by the bank. Though the singing faded during the choirs’ eventual orderly exit, further protesters disrupted the meeting with vocal criticism from the floor. Requests from Barclays Chair Nigel Higgins to “wait until the Q&A” to raise points were not heeded and the protesters were removed by

security.

But the Q&A session was in many ways more damaging to the bank’s reputation, as it faced numerous questions regarding stark contrast between the disastrous ecological impacts it finances and its stated environmental position, with Higgins often only able to repeat highly-arguable responses or avoid answering. Alongside highlighting Barclays’ role in deforestation (leading Higgins to claim “[we] have strengthened our Forestry and Agricultural Commodities Statement”, scotched here), multiple shareholders challenged the bank’s continued relationships with fossil fuel companies aggressively pursuing new oil and gas reserves, disregarding the IEA’s prescriptions in its NZE 1.5°C scenario with which Barclays claims to be aligned. Higgin’s contention that those prescriptions were made obsolete by the war in Ukraine contradicts statements from IEA head Faith Birol, who stressed to the IMF that while “extending production from existing fields” may be a short-term expediency, record energy profits should primarily be used by the oil and gas sector to “show it is serious about the transition to clean energy.” In addition, Higgins’ persistently referred to a 32% drop in Barclays’ financed energy emissions since a 2020 baseline as an indication of the bank’s progress and trajectory, but this reduction is by no means unique to Barclays, and attributed by analysts more to the fact that energy companies have been “swimming in money.”

When pressed on particular clients, following non-committal generalisations about due diligence, Higgins asserted vaguely that "a point will come where it is possible to identify clients who are not seriously engaged" with the transition away from fossil fuels. But rather than answering evasively, Barclays should reassure shareholders by addressing the compelling points made from the floor, with actions such as:

- Publishing quantitative, not qualitative, analyses of the bank’s exposure to fossil fuel assets likely to be stranded, not least in response to IEA forecasts that demand will peak before 2030

- Ending its relationship with the US Chamber of Commerce and other trade associations lobbying against progress on climate change policy

- Publishing details of its ‘client transition framework’, how it will work in practice, and what the restrictions will be on clients whose transition plans are not adequate

- Updating its policy on project and corporate finance for companies engaged in fracking, including midstream infrastructure, not least in light of legal challenges and revelations on abuses in Texas linked to companies that Barclays finances.

As one attendee asked the Chair, referring to moves away from financing new oil and gas projects already made by HSBC, NatWest and Lloyds, “[...] considering that everyone who has been chucked out of this meeting is doing their best to convince everyone that they can reach to drop Barclays, and that there are thousands more like them throughout the UK, is it really worth being the UK’s worst laggard in fossil fuel financing?”